To provide the best possible returns for our investors in the Trilogy Monthly Income Trust, we take all practicable steps to mitigate risk within our loan portfolio.

This includes securing first mortgages over all the properties we finance, as well as maintaining conservative Loan to Valuation Ratios (LVRs).

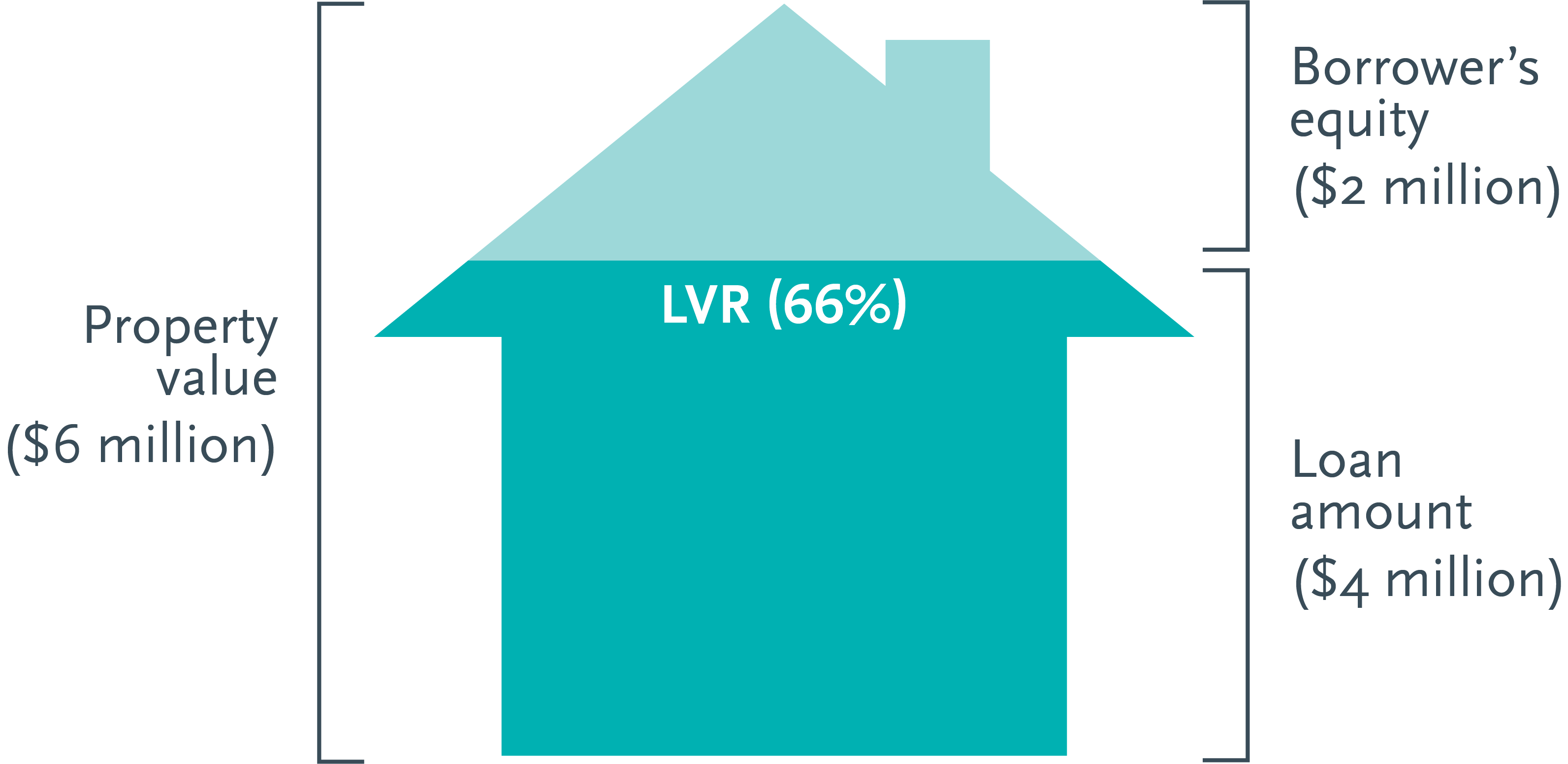

The Loan to Valuation Ratio explained

Loan to valuation ratio is a term used to express the ratio of a loan to the value of the underlying asset for which the loan will be used to fund.

For example, if a borrower has $2 million in equity and sought a $4 million loan for the development of a $6 million property, the LVR would be $4 million/$6 million, or just over 66%.

The lower the Loan to Valuation Ratio, the less risk to the lender. This is because the ‘excess’ value of the property over and above the loan amount provides a buffer that can help protect the lender in the event of a loan default, which could potentially result in a forced sale of the property for a lower price than expected, as well as additional interest and other fees and costs.

Loans with an Loan to Valuation Ratio above 80% are considered by many lenders to be high risk, and in the case of mortgages for home loans will generally result in borrowers being charged additional fees such as Lenders Mortgage Insurance or Lender Protection Fees. These are intended to compensate or to safeguard the lender against potential losses.

For more on property check out our tips for choosing the best location to invest or why mortgage trusts are a compelling option for investors >

As one of Australia’s leading specialist lenders to the property development and construction sector, the Trilogy lending team oversees a portfolio of over 85 loans that range in value of up to $20 million. Check out some of the recent loans funded by Trilogy.

This article was prepared by Trilogy Funds Management Limited ACN 080 383 679 AFSL 261425 (Trilogy) and does not take into account your objectives, personal circumstances or needs nor is it an offer of securities. Application for investment can only be made on the application form accompanying the Product Disclosure Statement (PDS) dated 17 December 2018 for the Trilogy Monthly Income Trust and available from www.trilogyfunds.com.au. The PDS contains full details of the terms and conditions of investment and should be read in full, particularly the risk section, prior to lodging any application or making a further investment. All investments, including those with Trilogy, involve risk which can lead to loss of part of or all your capital or diminished returns. Trilogy is licensed to provide only general financial product advice about its products and therefore recommends you seek personal advice on the suitability of this investment to your objectives, financial situation and needs from a licensed adviser to conduct an analysis based on your circumstances. Investments with Trilogy are not bank deposits and are not government guaranteed.