If you’re an investor seeking a property-based, professionally managed investment option offering competitive income and portfolio diversification, the Trilogy Monthly Income Trust might be an investment option for you.

The Trilogy Monthly Income Trust (Trust) is an unlisted pooled mortgage trust, which provides investors with exposure to returns available through loans secured by first registered mortgages over Australian property.

Interested to learn more about the Trust and how your investment is used to generate competitive returns? Read on, as we discuss everything you need to know about the Trilogy Monthly Income Trust.

How does the Trilogy Monthly Income Trust work?

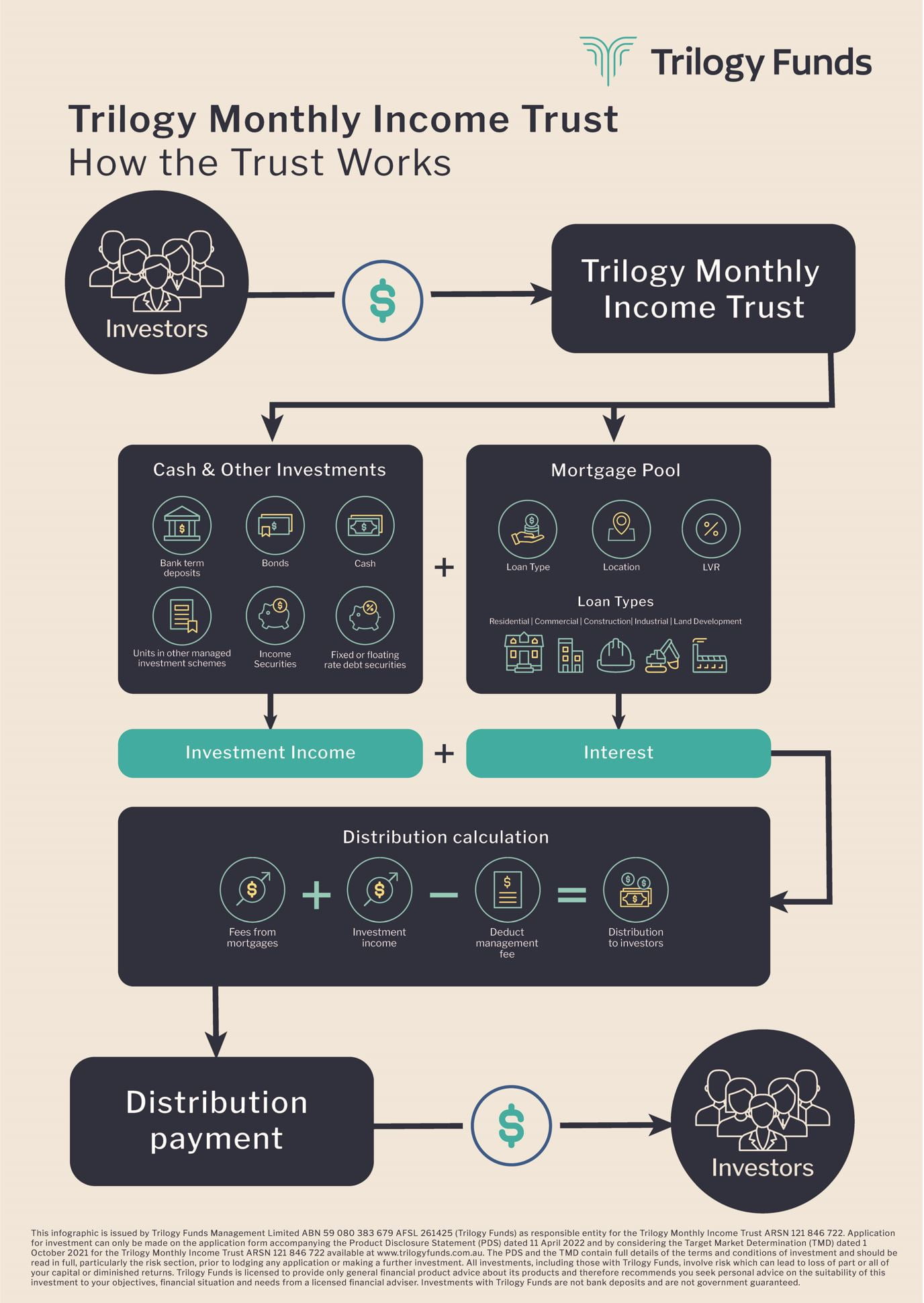

See how the Trilogy Monthly Income Trust works in the infographic below.

How does the Trilogy Monthly Income Trust generate income?

To invest in the Trilogy Monthly Income Trust, you simply purchase units in the trust – our experienced team then takes care of administration and asset management on your behalf.

The funds contributed by each investor are ‘pooled’ together and invested in two ways.

Assets of the Trust

Most of the funds are allocated to a ‘Mortgage pool’. The mortgage pool consists of property development and construction loans to the residential, commercial, industrial and retail property sectors in Australia.

The Trust aims to provide a critical level of diversification by lending to a wide range of:

- Loan types (developers, projects, and property sectors),

- Locations (across Queensland, New South Wales and Victoria), and

- Loan-to-Valuation Ratios (LVRs).

As at 30 April 2022, the Trust had 157 loans for projects such as townhouses, apartment buildings, industrial complexes, land subdivisions, childcare centres, homes, duplexes, and retail shops.

Income is generated from this mortgage pool via loan repayments, interest, and fees paid by the borrowers.

A portion of the Trust’s portfolio is allocated to ‘cash and other investments’, which are considered liquid investments, to manage the Trust’s current and future cashflow requirements.

These investments may include bank term deposits bonds, units in other managed investment schemes, cash, income securities and fixed or floating rate debt securities.

Income is generated for investors via the returns provided from these investments.

Distributions – How are they calculated and when are they paid?

The Trust aims to provide a monthly distribution based on the income generated. The returns are also determined relative to several external factors, including how interest rates are set and the returns provided by others in the market.

The distributions provided by the Trust are calculated by dividing the total income generated in the relevant distribution period (after the deduction of management fees, expenses, and any losses) by the number of units in the Trust.

The proceeds are then distributed among investors on a pro-rata basis, depending on their unit holdings.

You can expect to receive distributions on or around the eighth business day of each month, given funds are available, and you may choose to have them paid directly into your nominated financial institution account or reinvested as additional units in the Trust.

However, it is important to note that neither distributions or return of capital are guaranteed, and risks include the loss of part or all of your capital or diminished returns.

How do we choose loans to include in the Trilogy Monthly Income Trust?

We review loan applications to ensure we lend to quality borrowers and projects.

To ensure this, all loans funded by the Trust must meet strict lending criteria including (but not limited to):

- Security of a registered first mortgage

- Maximum loan-to-valuation ratio of 70% on the as-is or as-if-complete value, depending on the loan

- Asset value established by an independent, appropriately qualified valuer

- Acceptable property risk outlook for the sector and location

- No related party lending

- Adequate insurance must be held over the property

Learn more about how we choose loans to include in the Trust’s mortgage pool >

What measures are in place in the event a borrower defaults on their loan repayment?

While we aim to lend to high quality borrowers and projects, we have a range of risk minimisation measures in place designed to help reduce the potential financial impact in the instance a borrower defaults.

1. Loans secured by registered first mortgages

The Trust only accepts loans on a first registered mortgage basis. Apart from Government charges, a first registered mortgage has priority over all other liens or claims on a property in the event of default.

This gives Trilogy the right to take possession of a property and sell it to recover funds should a borrower stop making loan repayments or otherwise fail to honour the terms of a loan agreement.

2. Active management and loan drawdowns

Our experienced team of Portfolio Managers actively manage loan drawdowns. Prior to any release of funds, an independent Quantity Surveyor (QS), approved by Trilogy, will sign off on the progress draw to affirm the project completion timeframe is still as initially forecast.

If any deviation from the initial plan appears to arise, our Portfolio Managers will work with the borrower and the QS to resolve and rectify any roadblocks to get the borrower back on track.

What is the minimum investment amount?

The minimum investment amount for the Trust is $10,000. Please refer to the PDS for further details.

If I choose to withdraw my investment, how long does it take to get funds paid out?

The Trust is an open-ended scheme, meaning you can invest or request to withdraw your funds at any time. However, to ensure an adequate level of liquidity can be maintained, a four-month notice period is required for withdrawals (however, they may be processed and paid in a shorter time at our discretion).

The four-month notice period is in addition to the minimum holding period of two months applying to your initial investment. So, you should be prepared to hold units for at least six months from the date of issue of the units.

What risks are involved with investing?

As with any investment, the Trilogy Monthly Income Trust involves risks that you should be aware of. These are outlined in the Trust’s Product Disclosure Statement (PDS) dated 11 April 2022.

Key risks include risks of investing in a managed investment scheme, as well as the risks relating to the lending portfolio including exposure to building construction and development activities.

Please also read the Target Market Determination dated 1 October 2021.

It is crucial to ensure the investment risk profile of your investment choice suits your personal circumstances, financial goals and tolerance for risk. We recommend always seeking advice from a licensed financial adviser before making any investment decision.

This article is issued by Trilogy Funds Management Limited ABN 59 080 383 679 AFSL 261425 (Trilogy Funds) as responsible entity for the Trilogy Monthly Income Trust ARSN 121 846 722. Application for investment can only be made on the application form accompanying the Product Disclosure Statement (PDS) dated 11 April 2022 and by considering the Target Market Determination (TMD) dated 1 October 2021 for the Trilogy Monthly Income Trust ARSN 121 846 722 available at www.trilogyfunds.com.au. The PDS and the TMD contain full details of the terms and conditions of investment and should be read in full, particularly the risk section, prior to lodging any application or making a further investment. All investments, including those with Trilogy Funds, involve risk which can lead to loss of part or all of your capital or diminished returns. Trilogy Funds is licensed to provide only general financial product advice about its products and therefore recommends you seek personal advice on the suitability of this investment to your objectives, financial situation and needs from a licensed financial adviser. Investments with Trilogy Funds are not bank deposits and are not government guaranteed. Past performance is not a reliable indicator of future performance.