Builders and developers enjoyed a strong property market in 2021, yet some will remember it as the year of the ‘profitless boom’.

Demand for property soared, but developers also had to deal with surging land and construction costs, widespread shortages of materials and trades, council delays and other impacts of the COVID-19 pandemic.

What’s in store for property development and construction in 2022?

According to Trilogy Funds’ Head of Lending & Property Assets, Clinton Arentz, “While the scarcity of building supplies continues to delay projects and drive up building costs, there are good reasons for the construction sector to have confidence in favourable business conditions in 2022 and beyond.

“We’ve seen tremendous sales support over the last 12 months which has caused developers to bring projects forward or accelerate existing projects.

“While some delays in completing projects have resulted in developers drip-feeding product to the market, this has created a strong pipeline of demand, particularly in capital city locations.

“The return of international students and international migrants are an exciting prospect as we expect to see this demand continue throughout 2022,” says Arentz.

Read on to learn more about four areas of opportunity for property development and construction this year and how to take advantage of them.

1. Residential builders to be kept busy

Despite the end of the HomeBuilder grant scheme, demand for both detached home building and multi-unit construction remains strong, and this will be maintained throughout 2022 and 2023, says the Housing Industry Association (HIA).

Building approvals have remained consistently high. This pent-up demand for residential construction is likely to persist for some time to come as Australia’s economy bounces back and borders reopen, and HIA chief economist Tim Reardon says this will ensure ‘boom conditions’ for home builders are sustained.

“Multi-unit approvals (up 34.3% quarter on quarter) have also been recovering from the adverse impact of COVID-19…this is an encouraging sign that apartment construction will return prior to the return of overseas migration,” says Reardon.

When it comes to boutique residential developments such as townhouses, apartment buildings and duplexes, Arentz notes, “We’ve seen a range of high-quality boutique projects being proposed by developers seeking finance from Trilogy Funds, other non-bank financiers and more broadly in the market.

“Developers and architects are experimenting with different styles of product, often at a higher level of quality to meet expected ongoing demand.

“While demand is high, there are still challenges to navigate, such as construction cost escalation coupled with supply chain interruption, but developers who stick to detailed project plans will be able to generate optimal financial outcomes,” says Arentz.

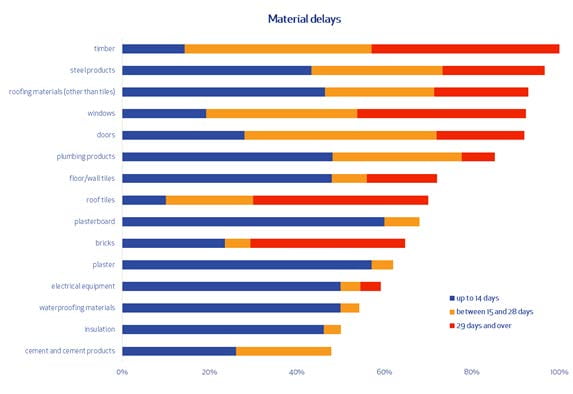

Source: Master Builders, Q3 2021

2. SDA housing receiving strong support from government

SDA (specialist disability accommodation) housing presents compelling opportunities for developers and investors as it attracts significant government funding through the National Disability Insurance Scheme (NDIS).

Kyle Hunt of the Health Care Providers Association says there is a general lack of awareness by investors and developers of the opportunities available in this sector.

“…We are seeing billions of dollars in potential funding remaining untouched,” Hunt says.

Trilogy Funds is proud to include tailored funding for NDIS and SDA projects in its broad lending offering and is looking to support more developers and projects in this space.

“In 2021 we co-funded SDA projects in both Sydney and Queensland,” says Arentz.

“We believe this sector will increase significantly over the next 10 years, not only due to government funding and participant demand, but also because of the opportunities it presents to support socially responsible projects.”

3. Commercial property benefiting from foreign investors

CBDs are expected to be reinvigorated as the COVID-19 health crisis recedes. Offices, shopping centres, student accommodation and hotels are expected to benefit from increased mobility and the reopening of international borders.

The commercial property sector is also being underpinned by strong interest from offshore investors, who, despite the closure of our international borders accounted for 33% of the volume of $1 million-plus commercial properties sold in Australia in 2021, snapping up assets ranging from offices to malls and aged care centres.

Knight Frank expects pent-up demand for office space to boost occupancies in 2022 and drive recovery in that market. There’s a flight to quality builds, suggesting that premium and upper A-grade space will be most sought-after.

Herron Todd White says there is strong interest in small, high-quality suburban office assets from both investors and owner-occupiers, providing opportunities for developers who can meet this need.

Many businesses in bricks-and-mortar retail have suffered as a result of the e-commerce boom that has spiked demand for logistics properties, but notable exceptions have included essential retailers like supermarkets, and smaller neighbourhood shopping malls. These have been the top pick for retail real estate investors recently.

Arentz also sees good opportunity in other commercial areas noting that, “Well thought-out commercial projects in good locations, particularly those that focus on education, health and wellbeing, and speciality services, will continue to remain in high demand, particularly by end users aligned to medical centres or essential service based mixed-use retail.”

4. Further tightening of industrial supply for prospective tenants

The industrial & logistics sector continues its strong run that began before the COVID-19 crisis, thanks in large part to the growth in e-commerce.

Vacancy rates are at record lows (just 0.4% in Sydney), and rents surged by double digits in some capital city markets in 2021 due to intense competition for warehousing.

Industrial completions nationally are expected to reach 2.4 million square metres in 2022, including 1.3 million square metres of new logistics facilities in the first six months alone.

“The demand for quality industrial space and specialist spaces such as cold-storage is expected to continue for some years, providing opportunities for developers with access to well-located land and a strong understanding of the type of assets required in that area,” says Arentz.

“A fund-through situation in which the tenant or multiple tenants are secured on long leases prior to construction may be ideal for developers and can be similarly attractive for investors and funds seeking to acquire the property.”

How to take advantage of these growth areas

- Ensure you understand the market into which you’re developing. As they say, location is everything, but so is knowing what type of project will provide the best Return on Investment

- Plan carefully. Be clear on your project plan, the risks involved and potential opportunities. Do this by leaning on specialists in the field such as valuers, quantity surveyors and property lawyers.

- Get your financing in order and work with a financier who understands property development and considers your project’s needs. “In a competitive market, there are many property development finance and construction loan options, but I would look for a financier who not only has good rates and terms but will provide that ongoing support you need to meet your project plans, from land acquisition right through to sales,” says Arentz.

Looking for a way to finance property development with a trusted financier?

Trilogy Funds offers tailored and flexible funding solutions to finance property development across the residential, commercial, industrial, and retail property sectors.

“We provide property development finance and construction loans across most states of Australia,” says Arentz.

“One key point of difference is our personal service. Contact us for a no-obligation discussion about financing your development or construction project,” he concluded.

This article has been prepared for existing and prospective borrowers and brokers and provides information only about Trilogy Funds’ lending services. Trilogy Funds Management Limited (Trilogy Funds) ABN 59 080 383 679 AFSL 261425 is not a licensed credit provider and does not make loans regulated by the National Credit Code. The source of Trilogy Funds’ loans may include managed investments schemes registered with ASIC, as well as other private lending arrangements with high net worth investors. If you would like more details on our investment opportunities, please contact us.