The strong returns generated by industrial and logistics property in recent years show no signs of abating, and the sector continues to offer many compelling opportunities for investors. However, as capital pours into an increasingly crowded market, unlocking value is becoming more challenging.

The last financial year was the best on record for the Australian industrial and logistics sector, which generated an incredible total return of over 23% in the year to June 2021, according to Colliers’ Industrial H2 2021 Research & Forecast Report. That outperformance is attracting strong investment inflows, and industrial completions nationally are expected to reach 2.4 million square metres in 2022, 60% up on the 1.5 million sqm constructed in 2017.

Yet despite this rapid expansion, supply continues to lag demand thanks to a ‘perfect storm’ of positive factors including a shortage of suitably zoned land; the ongoing rise in e-commerce penetration; an increased requirement for local warehousing and manufacturing facilities on the back of concerns over supply chain resilience; and expectations of strong economic growth as Australia re-opens after the Covid pandemic.

As owners are reluctant to sell in anticipation of further capital gains, I expect a further restriction of supply will occur. This will create significant competition for assets, force property prices upward and make it increasingly difficult to find value as an investor entering the sector in 2022.

However, there is still value to be found if you know where to look.

So, where can long-term value be found in industrial property in 2022?

Several trends are currently emerging in the industrial and logistics space that I believe are worth watching.

1. Rental growth

Strong capital growth in the industrial & logistics market over the past year has been driven by yield compression. However, in Knight Frank’s 2022 outlook for Australian property, they predict it will be rental growth that sustains the sector’s impressive returns this year and beyond.

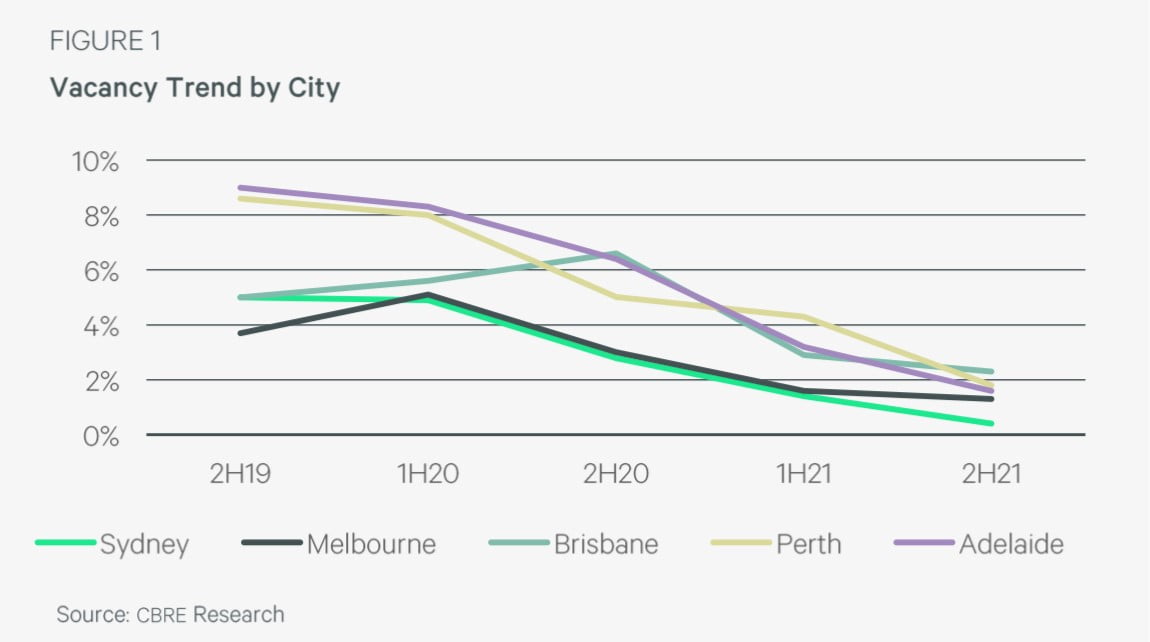

It’s no surprise that Knight Frank’s Top 10 Predictions for the Australian property market in 2022 include “Industrial Rents Shifting into Growth Mode” led by Sydney (5%) and Melbourne (6%), but with Brisbane, Perth and Adelaide not far behind.

2. Regional areas and major-city corridors to outperform

Knight Frank predicts that Melbourne’s western corridor, Adelaide’s outer north and the north of Brisbane are some of the areas likely to experience the strongest industrial demand in 2022.

I believe there is currently value to be found in regional areas and the areas surrounding capital cities in locations such as Geelong, Toowoomba, and Newcastle. Key regional hubs including Mackay, Cairns and light industrial areas around Darwin, Adelaide and Perth are also providing opportunities for investment value.

At Trilogy Funds, our most recent acquisition for the Trilogy Industrial Property Trust (Industrial Trust) was a 9,000 sqm warehouse facility located along the Brisbane-Sunshine Coast Narangba Innovation Precinct.

The Trilogy Industrial Property Trust’s latest acquisition at Magnesium Street, Narangba, Queensland

As for most investment portfolios however, diversification is key. A concentration of assets acquired in the major cities in recent years would currently be generating lower returns due to tight capitalisation rates.

A high concentration of assets in a single location or with common tenant types, can be more greatly impacted by changes in that location or industry sector.

3. New technologies

Tenants’ requirements are changing as businesses increasingly deploy new technologies such as AI, smart manufacturing and autonomous mobile robotics, and their workforces become more sophisticated.

As a result, modern facilities that provide greater flexibility and can cater for the growing uptake of digitisation and automation will be in greater demand, providing new opportunities for forward-thinking developers and landlords.

4. Upwards rather than outwards

To increase capacity without breaking new ground, industrial buildings are becoming taller. With land prices at a tipping point, I expect to see more multi-storey industrial developments emerge in higher density locations such as Sydney and Melbourne throughout 2022.

5. Sustainability

Industrial tenants are increasingly aware of energy management and ESG considerations. As a result, industrial property which integrate solar power and other green technologies will likely provide higher value.

Seeking properties which currently, or through further development could incorporate these considerations is a priority for our Trilogy Industrial Property Trust.

How we create value through the Trilogy Industrial Property Trust

As experienced fund managers, we understand the forces currently shaping the industrial and logistics sector.

We invest heavily in researching potential acquisitions and performing due diligence to identify pockets of potential value.

The Trilogy Industrial Property Trust’s first properties were acquired in 2019 in Mackay, a location which had suffered from the recent mining downturn and capitalisation rate at the time – however we saw its potential to recover.

The diversity of the Industrial Trust’s portfolio, which currently includes 12 properties spread across four states and a variety of urban and regional locations as well as various tenants across different sectors has helped it deliver competitive returns. The Trilogy Industrial Property Trust paid investors 7.60 CPU p.a.^ annualised for the month of December 2021. This is equivalent to a yield of 6.99% p.a. annualised based on the unit price of $1.0868 as at 1 December 2021.

We also believe that consistent, competitive property portfolio returns over the longer term depend on a high-quality, well-managed tenant base.

The Trilogy Industrial Property Trust allows investors to participate in one of the most sought-after asset classes today with a minimum investment of $50,000. It is designed to provide competitive income returns and the opportunity for capital growth over the long term.

As with any investment, there are risks associated with the potential rewards from industrial property investments and it is important to ensure the investment risk profile suits an investor’s personal circumstances. A licensed financial adviser can help investors who may be unfamiliar with this investment option. We encourage you to read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) to ascertain whether this product is right for you and consult a licensed financial adviser.

^Distribution amount for the month ended 31 December 2022. Net distributions are variable each month and are net of management fees, costs and assume no reinvestment. Distributions are paid monthly in arrears. Please note, past performance is not a reliable indicator of future performance.

This article is issued by Trilogy Funds Management Limited ABN 59 080 383 679 AFSL 261425 (Trilogy Funds) as responsible entity for the Trilogy Industrial Property Trust ARSN 623 096 944. Application for investment can only be made on the application form accompanying the Product Disclosure Statement (PDS) dated 1 July 2021 and by considering the Target Market Determination (TMD) dated 1 October 2021 for the Trilogy Industrial Property Trust ARSN 623 096 944 available at www.trilogyfunds.com.au. The PDS and the TMD contain full details of the terms and conditions of investment and should be read in full, particularly the risk section, prior to lodging any application or making a further investment. Past performance is not a reliable indicator of future performance. All investments, including those with Trilogy Funds, involve risk which can lead to loss of part or all of your capital or diminished returns. Trilogy Funds is licensed to provide only general financial product advice about its products and therefore recommends you seek personal advice on the suitability of this investment to your objectives, financial situation and needs from a licensed financial adviser. Investments with Trilogy Funds are not bank deposits and are not government guaranteed.