For investors looking to participate in the Australian property market, a pooled mortgage trust, such as the Trilogy Monthly Income Trust, is a unique property investment vehicle that offers several advantages for investors. Access to portfolio diversification, the potential for regular income and an experienced team to manage the opportunities and risks are generally considered the top three.

The significant capital cost of acquisition makes diversifying a property portfolio problematic, particularly for smaller investors who may not be able to afford to spread their investment risk across multiple property assets. The time, costs, tax impacts and experience required for ongoing management of property investments also reduce the attractiveness of a diversified direct property portfolio.

However, when you invest in a pooled mortgage trust such as the Trilogy Monthly Income Trust, your funds are pooled with those of the Trust’s other investors to finance a diverse range of property developments in the residential, commercial, industrial and retail sectors across the eastern seaboard of Australia. So, not only is the Trust’s portfolio diversified across multiple property sectors, it also has geographic, borrower and project lifecycle diversification amongst the array of loans it has secured by registered first mortgages.

The Trust’s income sources include proceeds from borrowers’ repayments, interest, fees and income from other investment holdings.1 This income (net of fees) is returned to the Trust’s investors as an income distribution, which, for the Trilogy Monthly Income Trust, we aim to pay monthly in arrears at a variable rate.

What is currently in the Trilogy Monthly Income Trust’s property portfolio?

As at 31 December, 2020^, the Trilogy Monthly Income Trust had over 90 different loans in the portfolio, with a weighted average Loan-to-Valuation Ratio (LVR) of 62.93% (“as-if-complete”) on a fully drawn basis and an average loan size of $5.39 million. The longest loan size is limited to $25 million. This structure provides a high level of diversification, which, together with our proactive loan management by our loan portfolio managers, aims to minimise potential impacts on the loan portfolio of any individual non-performing loans.

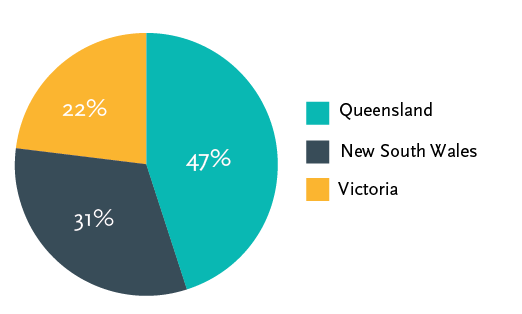

The Trust’s loan book is well diversified across Australia’s eastern seaboard, reducing the effects on investment returns of regional factors, which may cause state markets to perform differently to one another over a given period.

Geographic Spread as at 31 December 2020^

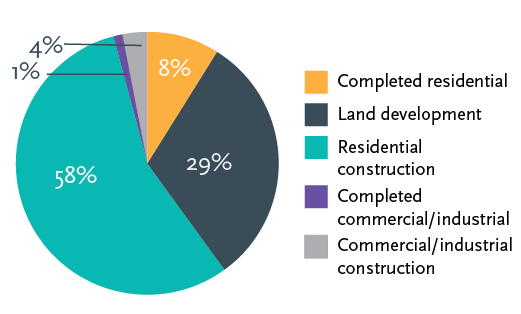

Loan Diversification as at 31 December 2020^

In terms of loan type, the Trust provides an additional layer of diversification for investors by financing a disparate range of project types that, while weighted in favour of the residential property sector, nonetheless spreads its investment risk across other property types too.

Another major advantage of investing in property via a pooled mortgage trust such as the Trilogy Monthly Income Trust is that the Trust is managed by a highly experienced team.

A recent review of the Trust by independent ratings agency Australia Ratings# gave it a ‘Very Strong’ investment rating, based in part on the high calibre of management.

Weekly meetings of the Trust’s Lending Committee assess each new loan application on its individual merits and monitor the performance of all existing loans.

Our lending criteria include the requirement that all loans must be secured by a registered first mortgage in favour of the Trust. The value of all properties is established by an independent and appropriately qualified valuer, loan amounts are restricted to a maximum LVR of 70% (“as-if-complete”), and adequate insurance must be held over the property at all times.

Trilogy is one of Australia’s leading fund managers of property-based investments. We’re passionate about helping our investors to build their wealth by providing product options that allow our investors to include property-based funds in their investment portfolios.

We always recommend investors obtain, read and understand the relevant Product Disclosure Statements and seek advice from a licensed financial adviser before investing.

Learn more about the Trilogy Monthly Income Trust or get in touch with our Investor Relations team >

1Full details of the Trust’s income sources are outlined in the Product Disclosure Statement.

^All figures are based on unaudited figures as at 31 December 2020 and may be subject to change. LVR is based on a “as-if-complete” valuation inclusive of GST. Please note, figures have been rounded to the nearest percent.

#The information contained in the Australia Ratings Analytics report and encapsulated in the investment rating is of a general nature only. The report and rating reflect the opinion of Australia Ratings Analytics Pty Limited (AFSL 494552). It does not take into account an individual’s objectives, financial situation, or needs. Professional advice should be sought before making an investment decision. A fee has been paid by the fund manager for the production of the report and investment rating.

This article has been prepared by Trilogy Funds Management Limited ACN 080 383 679 AFSL 261425 (Trilogy). The Trilogy Monthly Income Trust ARSN 121 846 722 is a registered managed investment scheme of which Trilogy is the responsible entity and issuer of units and is offered under a PDS dated 17 December 2018 available at www.trilogyfunds.com.au. Trilogy provides only general financial product advice on its own products and does not consider your objectives, financial situation, or needs in providing such advice. Information included in this communication about investment yield and returns should be considered only as part of a balanced review of all the features, benefits and risks associated with the product. Please read the PDS in full. Investors may lose part or all of their capital or there may be periods when their returns are diminished. Investments in Trilogy’s products are not bank deposits and are not government guaranteed.