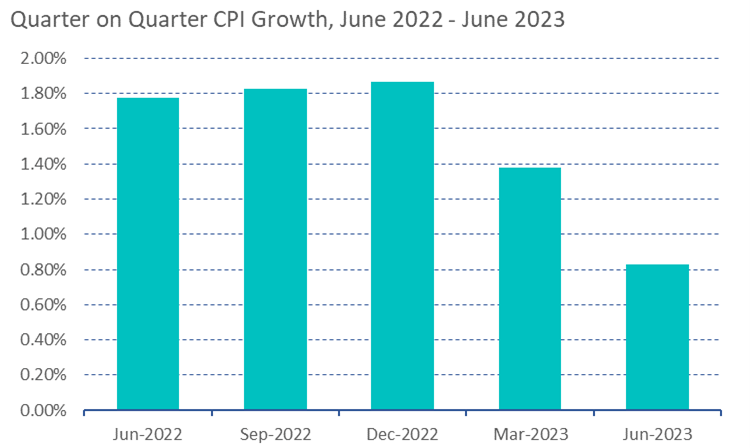

Last week, the Australian Bureau of Statistics published the CPI data for June 2023. The news on inflation has been upbeat for several weeks, and the latest release shows a decline in annual inflation to 6% for the period of 12 months leading up to June 2023. Furthermore, a closer look at the quarterly CPI movements reveals an even more encouraging trend.

Source: Australian Bureau of Statistics

The growth of CPI has been consistently slowing each quarter since December of last year. The most recent report shows a quarterly inflation rate of 0.8% in the June quarter. Annualised, this equates to 3.24%p.a – which would be the rate of inflation over four quarters of 0.8% quarterly inflation. This trend should provide some assurance to the Reserve Bank of Australia that their monetary policy targeting inflation is working.

There has been a lot of media attention on the Reserve Bank of Australia (RBA) due to Governor Philip Lowe being replaced by Michelle Bullock, the central bank’s first female Governor. With her previous role as Deputy Governor, it is expected that there will not be significant changes in policy under her leadership. However, Ms. Bullock will be responsible for implementing changes such as reducing the number of Board meetings that determine official interest rates. From 2024, there will only be eight meetings a year, four on the first Tuesday of February, May, August, and November, and the other four midway between them.

The Bank Board met yesterday and decided to keep target rates steady at 4.10%. In doing so, the outgoing RBA Governor stated the 400 basis points of target rate increases since May last year are “working to establish a more sustainable balance between supply and demand in the economy and will continue to do so.” Between this and ongoing uncertainty, the bank has determined that holding rates steady will allow time to assess the full impact of increases to date.

I would like to make some comments about the challenges facing parts of the commercial property sector.

As we all know, property is a long-term investment – and commercial property can be a particularly long-term consideration. Construction of buildings and premises designed to fulfil specific commercial, or tenant purposes is resource and capital intensive. These assets, from an investment perspective, are intended to provide a return to investors in the form of income and potential capital gain. Tenants and their business’ evolving requirements impose on landlords a need to be responsive and prepared in today’s leasing market. In addition to asset specific matters such as tenant profiles and stickiness, property is also an asset class that can be highly leveraged which makes it sensitive to interest rate movements.

Certain property sectors, like many economic sectors, are still recovering from the COVID pandemic. Moreover, there are some global thematics emerging from the pandemic. The global shift towards online retail trade was exacerbated during the pandemic as individuals had more time, and more necessity, to find and purchase the goods they need, online, and have them delivered.

Another thematic is the corporate world’s need to embrace remote working. During the pandemic, corporates had to implement processes and infrastructure to facilitate staff working from home. These processes and infrastructure now allow many corporates to continue employing remote working staff.

Although significant challenges for certain property sectors remain, markets are prone to correct over time to reflect changes in demand and supply conditions.

That said, the tailwinds supporting the industrial property sector are notably distinct, and much more positive. The continuing surge of online shopping has resulted in a greater need for warehousing and logistics. As online commercial activity grows, so too does the demand for data storage facilities – a demand also driven by remote working trends. These trends support a growing demand for industrial space.

Knight Frank Australia and CBRE Research have confirmed that the industrial sector has experienced strong rent growth this year despite increased interest rates and funding costs. Although development activity has increased gradually over the past few years, demand has remained ahead of supply, resulting in a structural shortage of space and immediately developable land for industrial use.

We have long recognised the potential of the industrial sector, driven by these thematics and we are pleased with the ongoing performance of our own Industrial Property Trust.

We are proud to announce that our funds were finalists in the prestigious Financial News Wires/SQM Fund Manager of the Year in 2023, for the second year in a row; and were recognized as one of the Top Five Property Funds by Livewire in 2022.

In addition, we congratulate Ryan Mooney, the Trust’s Manager, on his Rising Star of the Year award, showcasing the talent we’re fortunate to have within our team.

Related Articles:

This article is issued by Trilogy Funds Management Limited ABN 59 080 383 679 AFSL 261425 (Trilogy Funds) as responsible entity for the management investment schemes mentioned in this article. Application for investment can only be made on the application form accompanying the relevant Product Disclosure Statement (PDS) and by considering the Target Market Determination (TMD) available at www.trilogyfunds.com.au. The PDS contain full details of the terms and conditions of investment and should be read in full, particularly the risk section prior to lodging any application or making a further investment, together with the TMD. All investments, including those with Trilogy Funds, involve risk which can lead to no or lower than expected returns, or a loss of part or all of your capital. Trilogy Funds is licensed to provide only general financial product advice about its products and therefore recommends you seek personal advice on the suitability of this investment to your objectives, financial situation and needs from a licensed financial adviser. Investments with Trilogy are not bank deposits and are not government guaranteed. Past performance is not a reliable indicator of future performance.