The Australian economy has navigated a challenging 2023. The lingering impact of Covid-19 on supply-chains, global uncertainties, the worsening housing crisis and, of course, the inflation threat, all presented significant headwinds. Despite these headwinds, the economy has shown remarkable resilience.

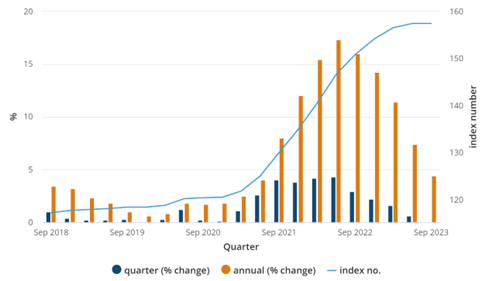

A key theme of 2023 was the tapering off in the growth of housing construction input costs. The years 2021 and 2022 both saw rapid increases in these costs as measured by the Australian Bureau of Statistics Producer Price Indices. While price growth continued in 2023, we saw a significant tapering of that growth and between the June and September quarters, there was no growth in the index.

This was a welcome development for the construction industry. Aside from providing Australians with housing, places to conduct business and trade, the construction industry employs over 1.3 million people, or 9.4% of the Australian workforce. As such, improvements in the prospects for construction also have positive implications for the broader economy.

The latest ABS employment statistics (August 2023) showed the construction industry workforce grew during the year, employing 3.8% more people in August 2023 than it did in August 2022. The industry’s contribution to total employment grew from 9.3% in August 2022 to 9.4% in 2023.

Housing crisis: a double-edged sword

Another key theme for 2023 has been the housing crisis. Between rising interest rates (covered below) and rising house prices, home ownership is becoming increasingly difficult. Nationally, home prices rose by 3.9% in the year to 30 September 2023, with prices in the state capitals rising by 5.1%, according to Core Logic. Compounding this challenge for home-seekers, Core Logic reported that vacancy rates in rental properties fell to 1.1% nationally, and 1.0% in capital cities, respectively. The tightness in the rental markets drove rents up by 8.4% nationally in the 12 months to 30 September, with capital city rents rising by 10.0%.

This presents a clear challenge for many consumers, for whom accommodation is a significant portion of their budget. This can also have impacts on people’s spending habits outside accommodation as their disposable income is absorbed into rent expense; and the fall in disposable incomes could impact businesses that depend on discretionary spending.

The flip side to this coin is that the strong demand for housing and the rental squeeze acts as a supporting force to property prices, even at a time when interest rates are elevated. This is positive for home owners, property investors and the construction industry.

Inflation: a persistent challenge

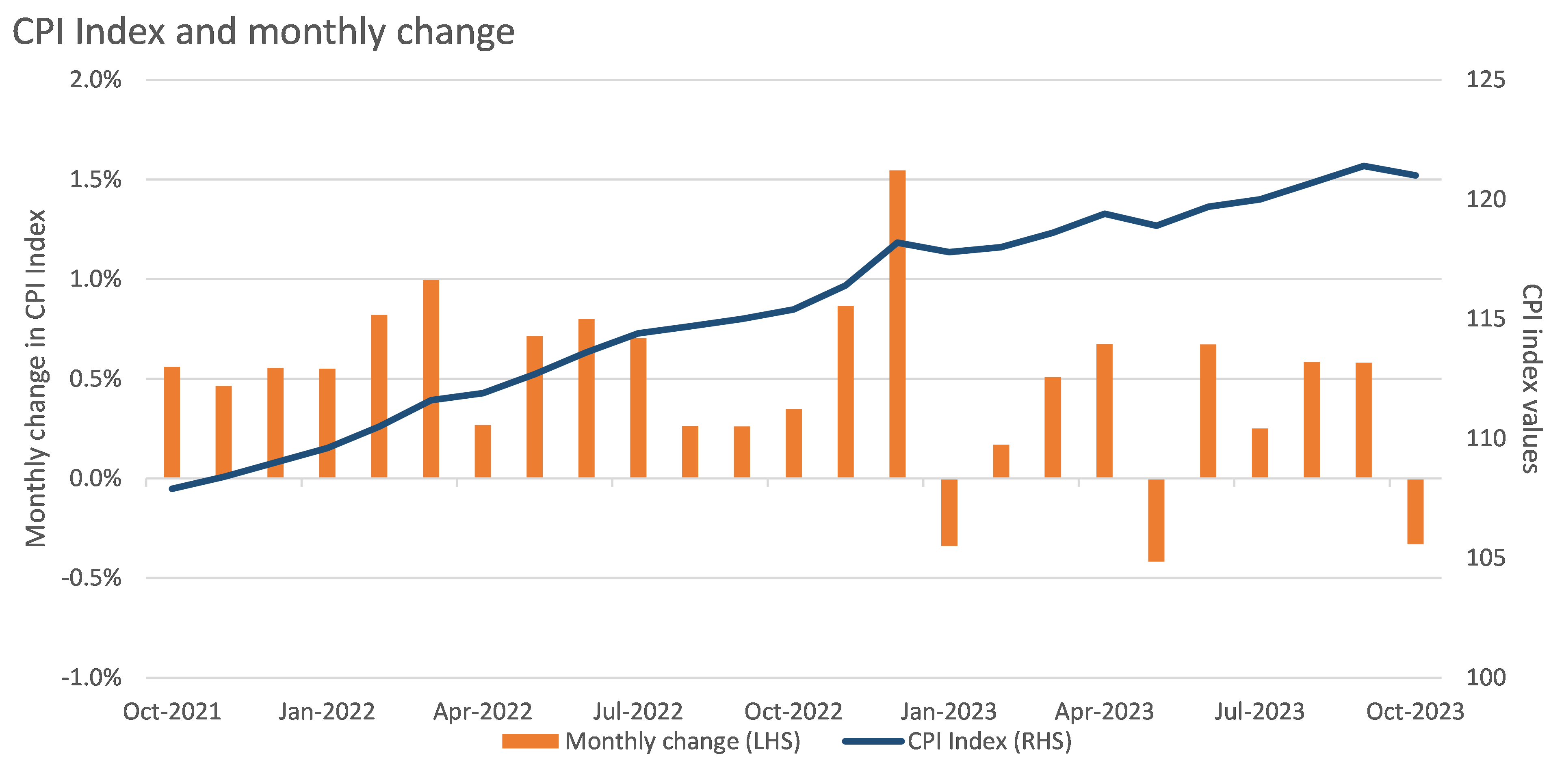

Inflation peaked in December 2022 with annual inflation reaching a 22-year high of 7.8%. While 2023 has certainly seen inflation come down from its peak, the challenge persists.

Utilities such as electricity and gas prices increased by 12.6% in the 12 months to September 2023. While this contributes directly to CPI growth, it also contributes to the growth in the prices of services that require gas and electricity to deliver. The rise in energy prices is being driven by global supply and demand dynamics, including the impact of the conflict between Russia and Ukraine.

While the month by month change in CPI seems to have stabilised somewhat in 2023, which is good news, inflation does remain elevated, and this has been a key cause for caution on the part of the Reserve Bank of Australia (RBA).

In October, the ABS reported a drop in the CPI Index and this was likely viewed as a welcome development by the RBA today when considering their last rates decision for 2023.

Interest rate hikes

Over the course of 2023, the RBA did adjust its expectations of inflation. However, the RBA has been consistent in making its priority clear – to bring inflation towards the target range of 2%-3%p.a. To that end, the RBA increased interest rates a total of five times, bringing the target cash rate to 4.35% in November 2023. It’s also worth noting that 2023 was effectively a continuation of rate rise increases starting in May 2022 when the RBA increased target rates from 0.1% to 0.35%.

Today, following the RBA Board’s last meeting of the year, Governor Bullock again positioned a return to target inflation as the Board’s key priority. She acknowledged the uncertainties presented by the Chinese economy, conflicts abroad and the outlook for household consumption. Contrasting this, the Governor also acknowledged encouraging signs regarding goods inflation abroad, and that October CPI figures indicate a continued moderation of inflation locally. She also stated that “higher interest rates are working to establish a more sustainable balance between aggregate demand and supply in the economy”.

The RBA ultimately decided to pause target rates in their last meeting of 2023.

Outlook going into 2024

Inflationary pressures and increased interest rates will impact the Australian economy. The RBA forecasts the economy to be more resilient than previously expected, however, the Bank projects GDP growth to slow to 1.75%p.a., on average in 2024. While this is below trend, it is higher than previously expected, with weaker projected household spending expected to be offset by stronger than expected private and public sector investment.

From a property perspective, the existing housing shortage will only be compounded by continued growth in the population. The Centre for Population Projections forecasts the population to grow to 26.32 million by 30 June 2024, and 26.68 million in the 12 months following.

On the one hand this will represent a serious challenge to the Government’s endeavours to solve the housing crisis. On the other hand, the ensuing growth in demand for accommodation should flow through to support for property prices and demand for ongoing housing construction – of which both are good for property investment.

Related Articles:

This article is issued by Trilogy Funds Management Limited ABN 59 080 383 679 AFSL 261425 (Trilogy Funds) as responsible entity for the management investment schemes mentioned in this article. Application for investment can only be made on the application form accompanying the relevant Product Disclosure Statement (PDS) and by considering the Target Market Determination (TMD) available at www.trilogyfunds.com.au. The PDS contain full details of the terms and conditions of investment and should be read in full, particularly the risk section prior to lodging any application or making a further investment, together with the TMD. All investments, including those with Trilogy Funds, involve risk which can lead to no or lower than expected returns, or a loss of part or all of your capital. Trilogy Funds is licensed to provide only general financial product advice about its products and therefore recommends you seek personal advice on the suitability of this investment to your objectives, financial situation and needs from a licensed financial adviser. Investments with Trilogy are not bank deposits and are not government guaranteed. Past performance is not a reliable indicator of future performance.